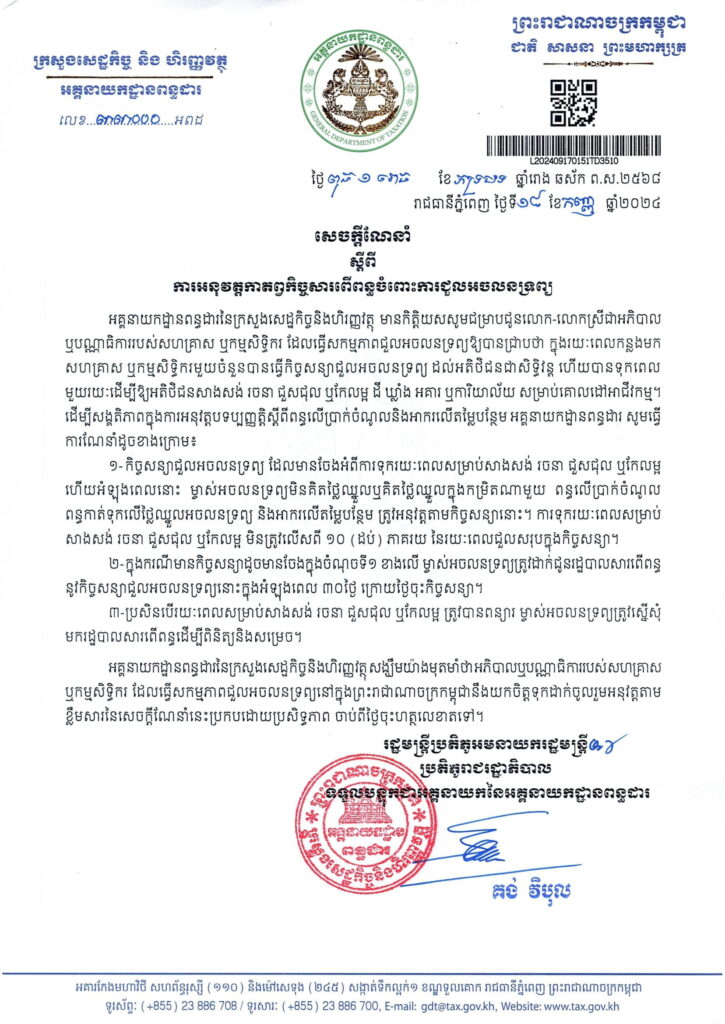

Cambodia’s General Department of Taxation (GDT) has introduced new guidelines clarifying the tax obligations for immovable property leases that include periods for construction or renovation.

Issued on September 18, 2024, Instruction No. 33000 offers a business-friendly approach by defining a grace period for rental payments, providing much-needed clarity for property owners and lessees.

The 10% Maximum Grace Period

The new instruction allows for a tax grace period for leases that have a rent-free or reduced-rent period for the purpose of construction, design, renovation, or improvement.

The key takeaway is that this allowed period shall not exceed 10% of the total lease term specified in the agreement. During this time, the applicable Tax on Income (TOI), Withholding Tax (WHT), and Value Added Tax (VAT) will be based on the rental amount stipulated in the contract, even if that amount is reduced or zero.

This measure is designed to give lessees a reasonable timeframe to prepare a property for business use without an immediate tax burden related to standard rent.

Tax Compliance Obligations for Property Owners

To benefit from this grace period, property owners must adhere to specific notification requirements set by the GDT.

- 30-Day Notification: The property owner is required to submit the lease agreement to the tax administration within 30 days of the contract’s signing date. This ensures the GDT is officially notified of the rent-free or reduced-rent arrangement.

- Approval for Extensions: If the planned period for construction, renovation, or repair needs to be longer than the 10% allowance, the property owner must submit a request to the tax administration for prior review and approval.

These steps are crucial for ensuring compliance and avoiding potential tax liabilities. This instruction is effective from its date of signature, September 18, 2024.

Checkout the detail of the instruction below: