Auditing and accounting firms in Cambodia are governed by the Law on Accounting and Auditing, promulgated under Royal Kram No. NS/RKM/0416/006, dated 11 April 2016.

To legally provide accounting and auditing services, a firm must first be established as a registered company in Cambodia, which involves registration with the Ministry of Commerce (MoC) and the General Department of Taxation (GDT).

Additionally, the firm is required to obtain membership with the Kampuchea Institute of Certified Public Accountants and Auditors (KICPAA) and secure a professional license from the Accounting and Auditing Regulator (ACAR).

For any firm intending to provide auditing services to Public Limited Enterprises, such as financial institutions or companies listed under the supervision of the Securities and Exchange Regulator of Cambodia (SERC), further licensing is required.

Such firms must obtain additional authorization from either the National Bank of Cambodia (NBC) or the SERC, depending on the nature of their clients.

ACAR currently issues three types of licenses to accounting and auditing firms practicing in Cambodia follow the Prakas No. 019 on the Management of Accounting and Auditing Profession Licenses:

Prakas No. 019 NBFSA.BrK, issued on April 20, 2023, outlines the rules governing the licensing, renewal, suspension, and revocation of accounting and auditing profession licenses in Cambodia. It applies to both natural persons and legal entities, specifying eligibility criteria, required documentation, obligations, and professional conduct standards.

The Prakas establishes two levels of accounting licenses and one auditing license, each with defined scopes and conditions. It also includes provisions on fees, validity, reporting obligations, and penalties for non-compliance.

License holders must comply with the Law on Accounting and Auditing, ethical standards, and reporting requirements to maintain professional practice under ACAR’s regulation.

Here’s the level of the License:

1. Level 1 Professional License in Accounting

Firms holding this license are authorized to provide the following services:

- Recording accounting transactions

- Preparing financial reports

- Providing accounting advice

- Reviewing accounting records

- Offering other similar accounting services as determined by ACAR

2. Level 2 Professional License in Accounting

Firms holding a Level 2 license may provide a more limited scope of services, including:

- Recording accounting transactions

- Preparing financial reports

- Other similar accounting services as determined by ACAR

3. Professional License in Auditing

Firms licensed for auditing services are authorized to perform:

- Auditing of financial statements

- Recording accounting transactions

- Preparing financial reports

- Providing accounting advice

- Reviewing accounting records

- Other similar accounting services as determined by ACAR

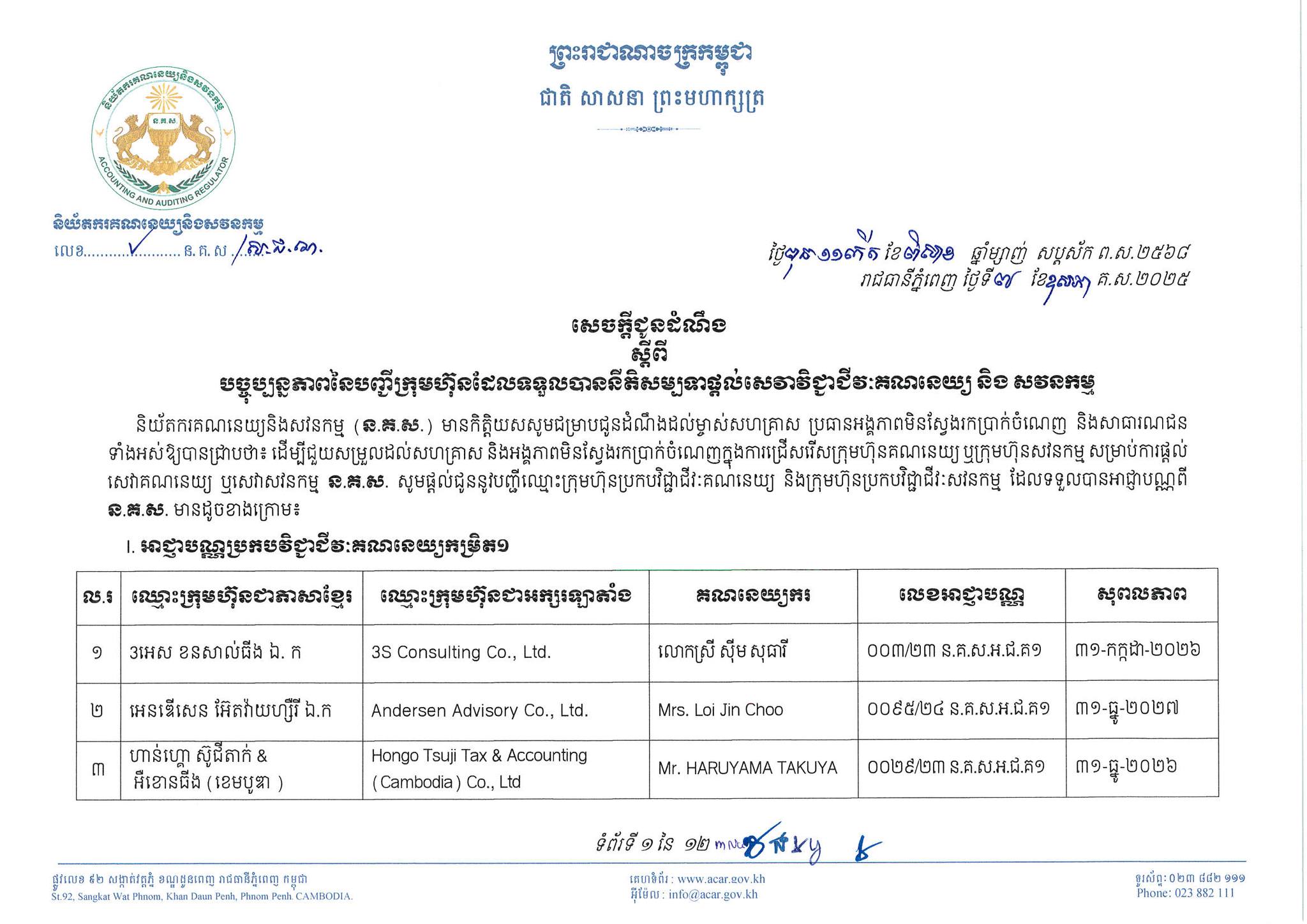

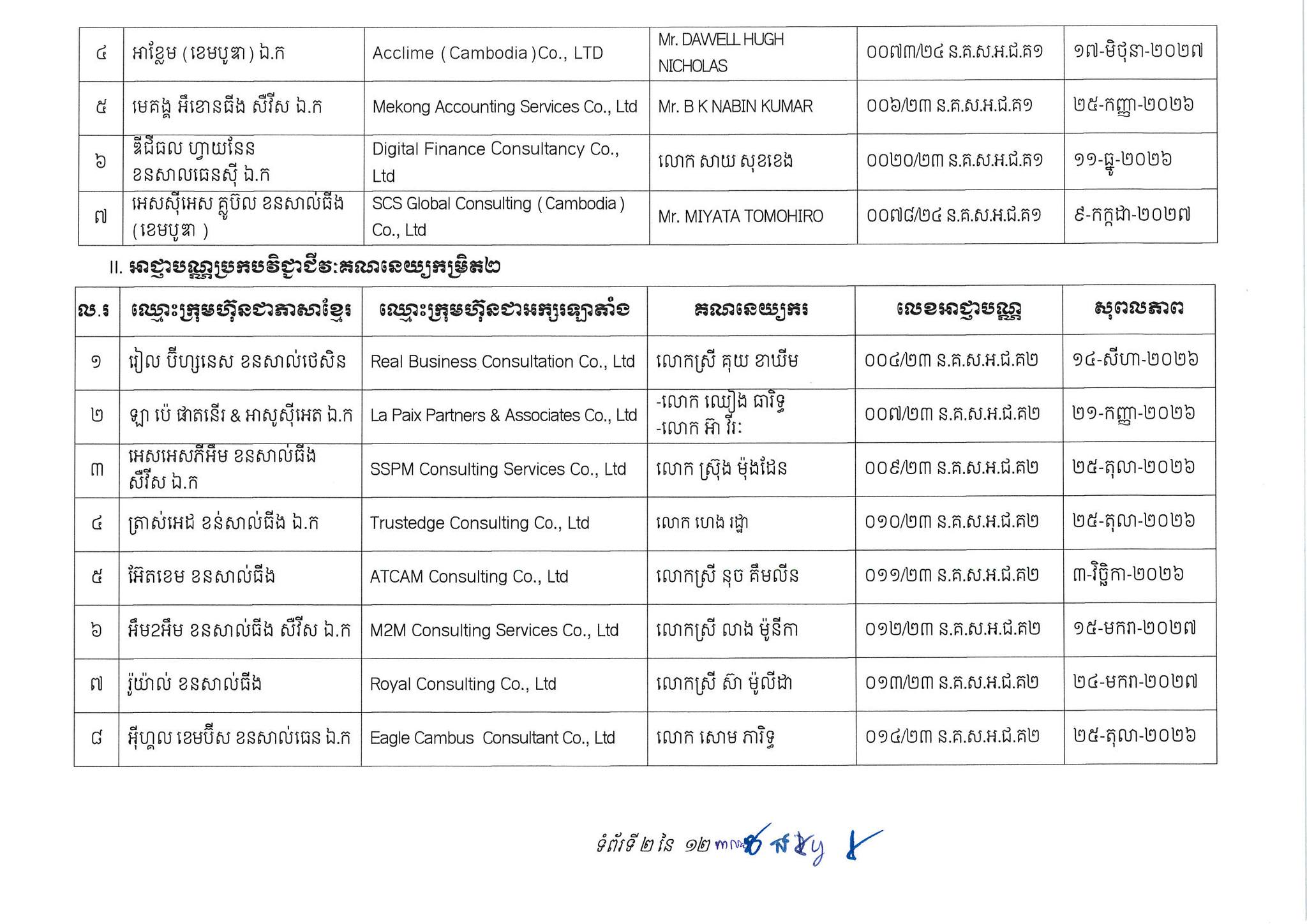

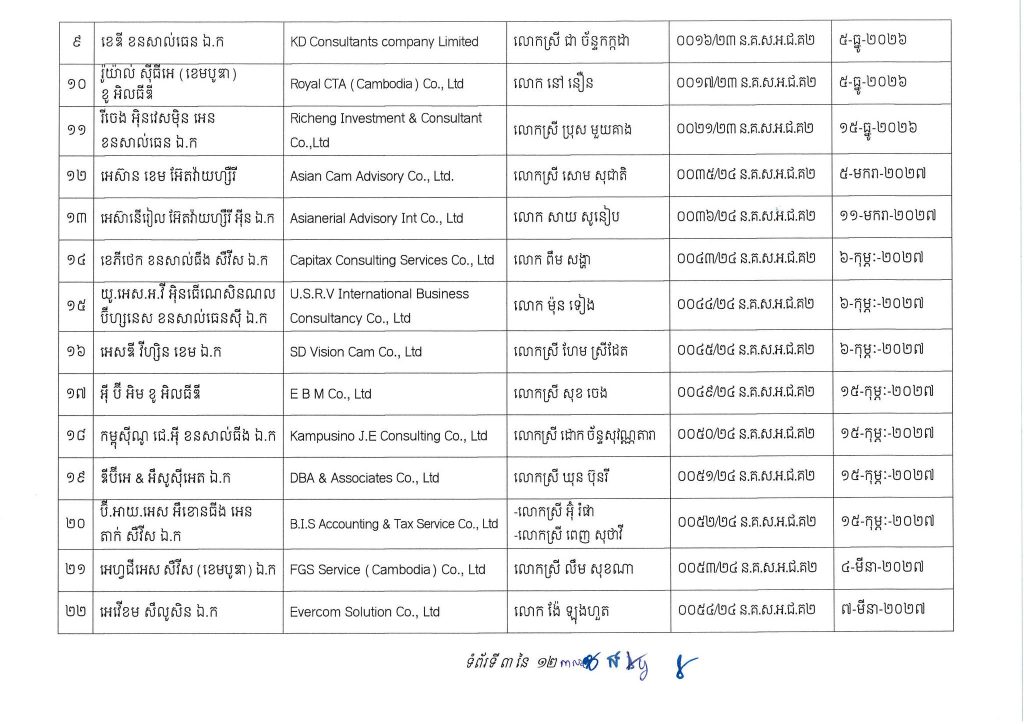

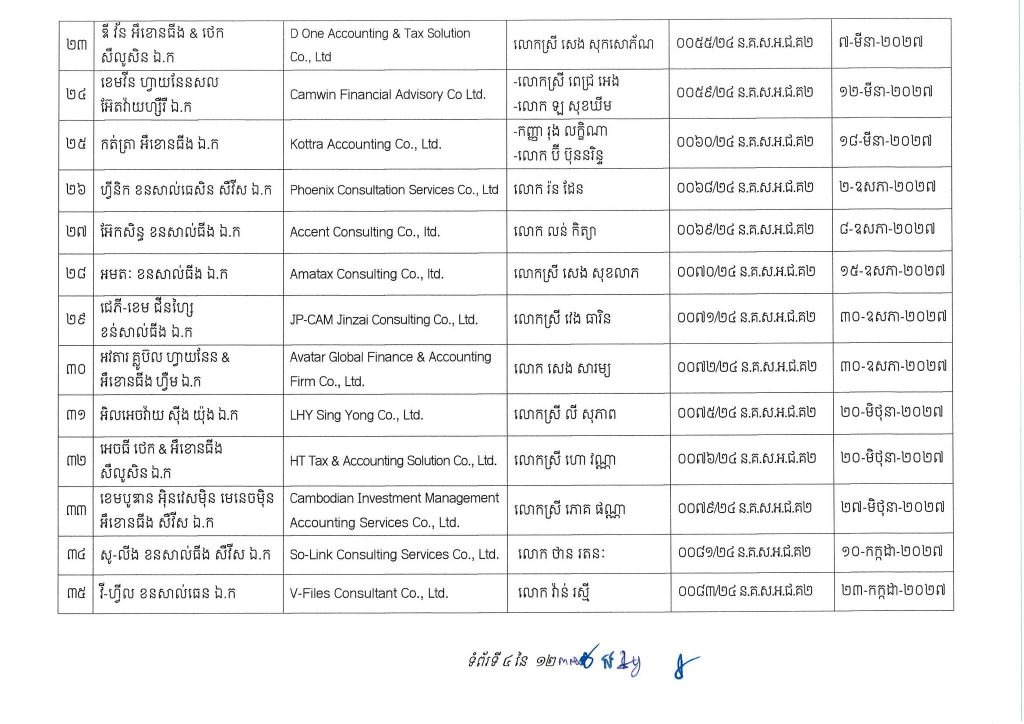

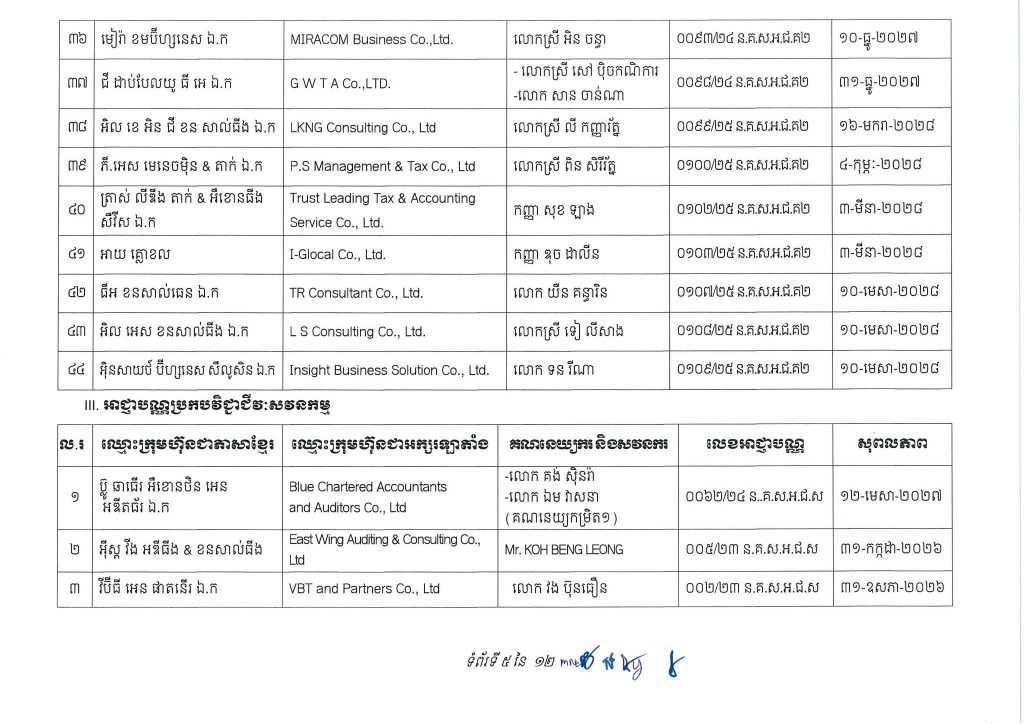

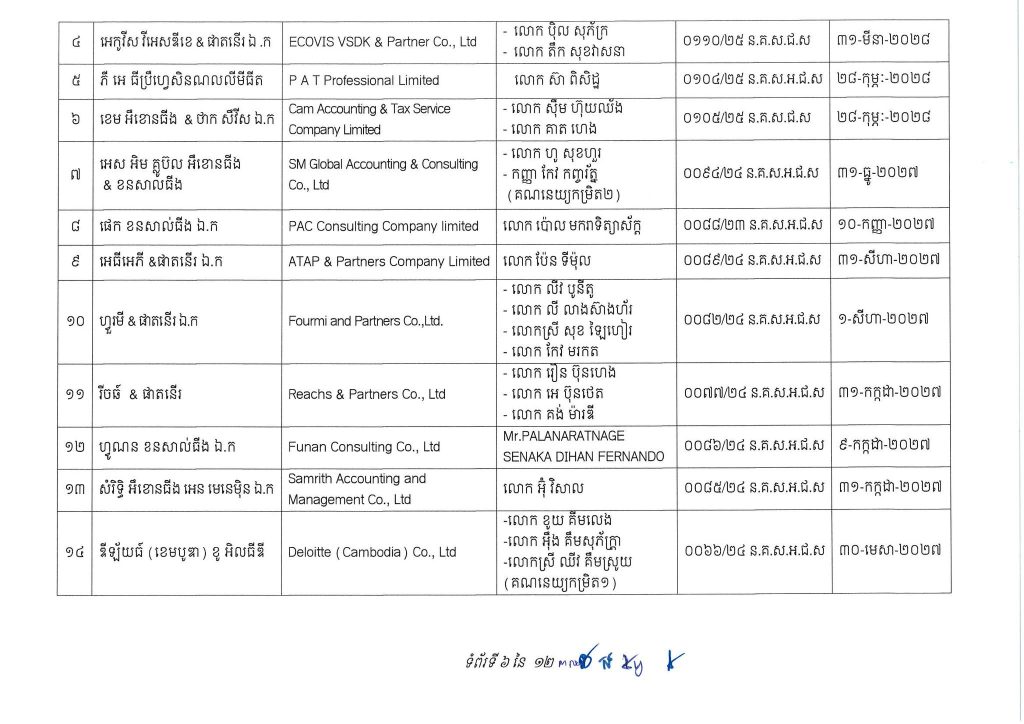

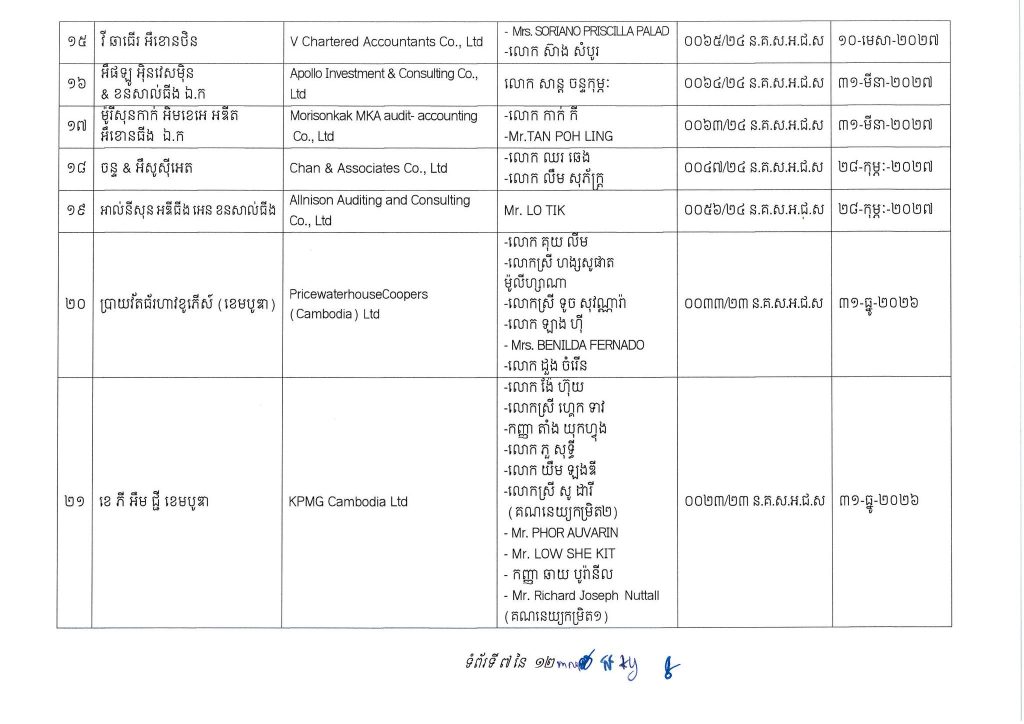

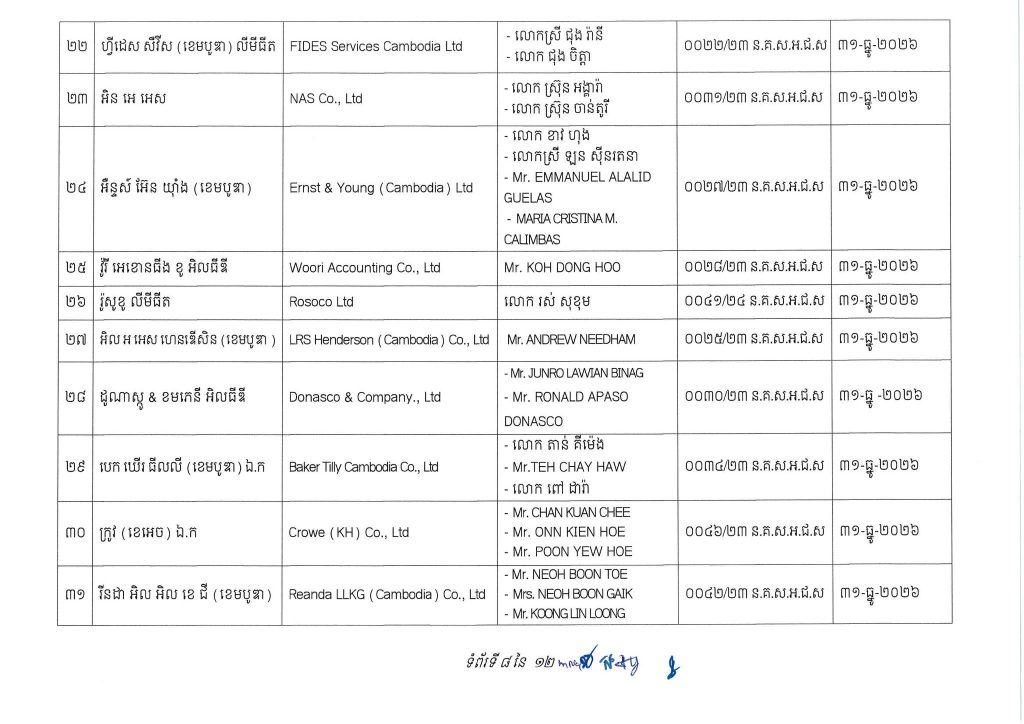

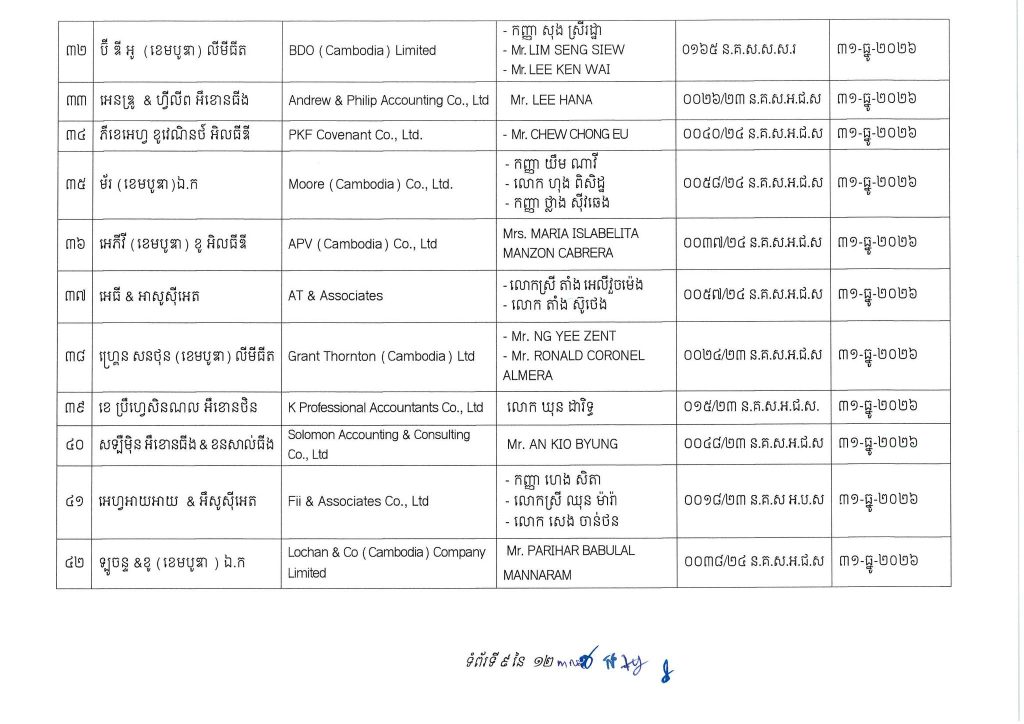

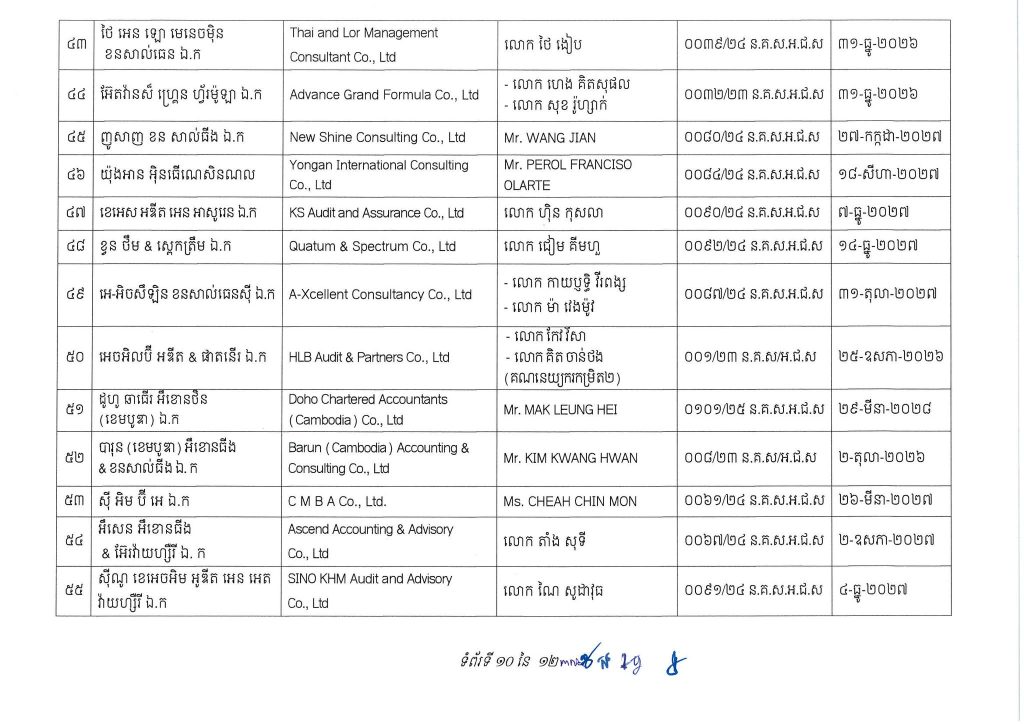

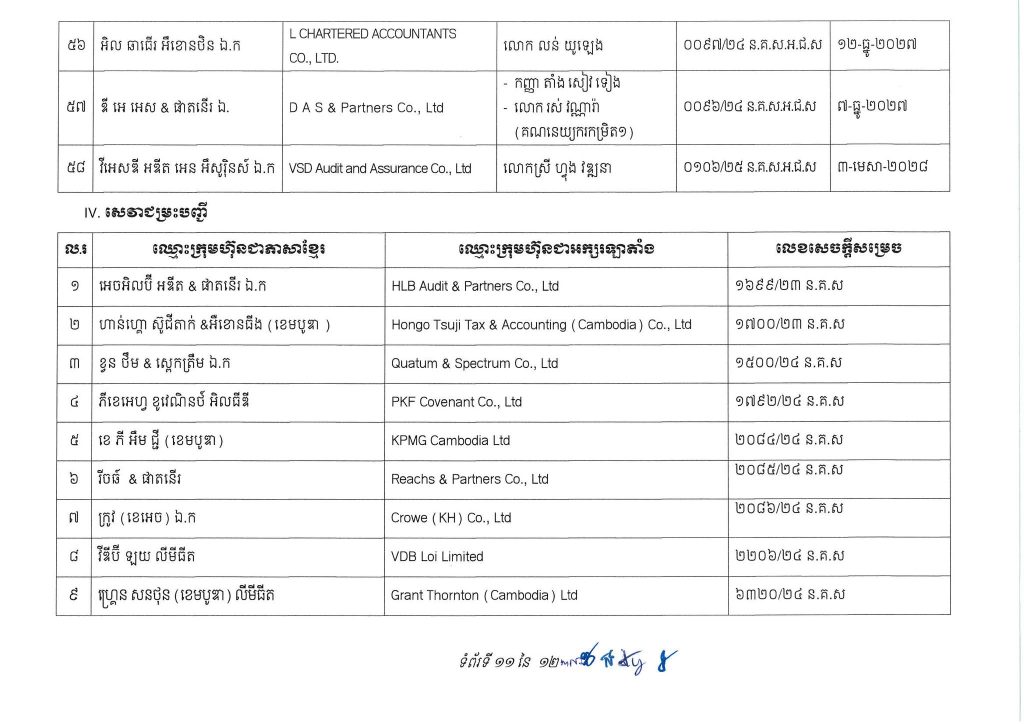

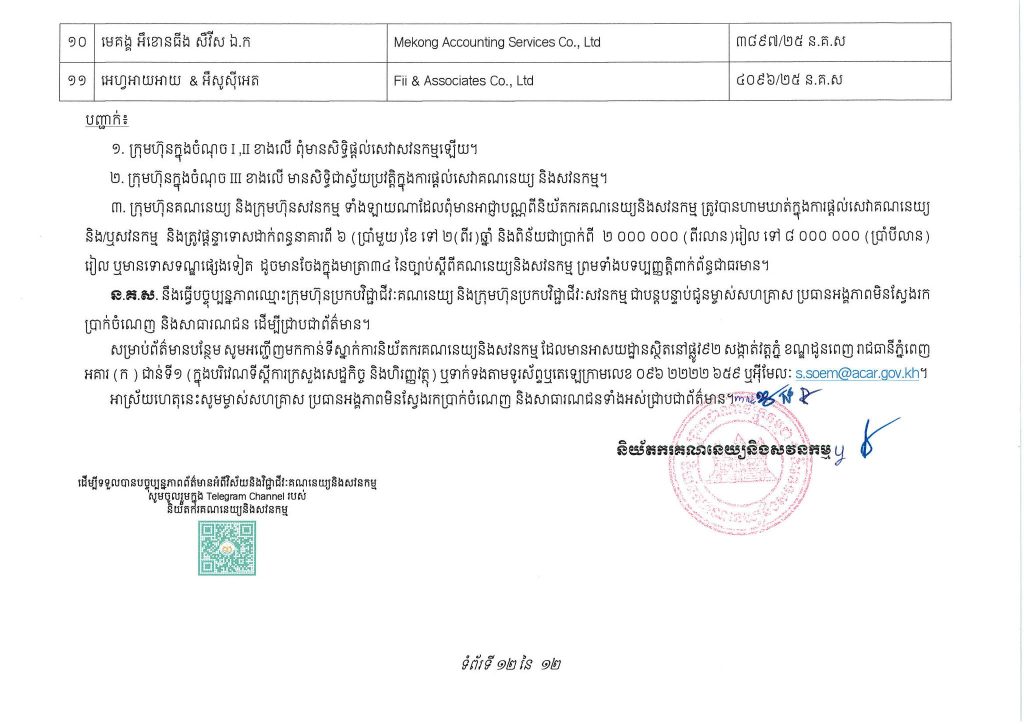

As of 7 May 2025, ACAR announced that a total of 102 firms had been granted licenses to provide accounting and/or auditing services. This comprised 7 firms with a Level 1 Professional License in Accounting, 44 firms with a Level 2 Professional License in Accounting, and 58 firms with a Professional License in Auditing.

VSD Audit and Assurance is granted an Auditing Practice License by ACAR, allowing it to provide full auditing and accounting services as described under all license types above.

Here with the list of accounting and auditing firm who granting the license in Cambodia.

The latest list of audit firm could be accessed here or you also can check in the ACAR website.

Any firm offering accounting or auditing services without obtaining the appropriate license from ACAR is considered operating illegally.

Reports, audits, or other outputs issued by such unauthorized firms are not officially recognized or accepted by regulators, government authorities, financial institutions, creditors, or other stakeholders within Cambodia.

ACAR regularly publishes an updated list of licensed accounting and auditing firms, which is available on its official website. Alternatively, the latest list can be downloaded through the link provided below.

FAQ Based on Prakas No. 019 NBFSA.BrK (April 20, 2023)

1. Who is required to obtain a professional license under this Prakas?

Any natural person or legal entity intending to practice accounting and/or auditing in Cambodia must obtain a license from the Accounting and Auditing Regulator (ACAR).

2. What types of licenses are available for accounting and auditing professionals?

There are two main types:

– Professional License of Accounting, classified into:

– Level 1 (full accounting services)

– Level 2 (limited accounting services)

– Professional License of Auditing, which also permits accounting and liquidation services.

3. What are the eligibility criteria for obtaining these licenses?

Applicants must:

– Be a KICPAA member (active, affiliate, or associate depending on the license level)

– Be a Cambodian national

– Have no criminal record

– Not hold executive roles in other entities

– Meet ethical standards and submit required documents, including business registration, tax certificates, and a business plan.

4. What is the process for applying for a professional license?

Applicants must:

– Submit a completed application form to ACAR

– Attach all required documents

– Pay the application and review fees

– ACAR must respond within 15 working days after receiving a complete application.

5. How long is the professional license valid, and what is the renewal process?

The license is valid for 3 years. Renewal requires:

– Submission 45 days before expiration

– Updated financial statements, ethics confirmation, and CPD evidence

– Payment of renewal fees

– Continued compliance with all ACAR requirements.

6. What obligations do license holders have under this Prakas?

License holders must:

– Follow the Law on Accounting and Auditing

– Adhere to ethics and technical standards

– Submit annual reports to ACAR

– Maintain insurance (for auditors)

– Notify ACAR of changes and suspicious transactions

– Display the license publicly.

7. What are the penalties for non-compliance with the Prakas?

Penalties include:

– Warnings or reprimands

– License suspension or revocation

– Fines

– Practicing without a valid license is considered a legal offense.

8. How does this Prakas relate to the Law on Accounting and Auditing?

This Prakas serves as an implementing regulation under the Law on Accounting and Auditing, detailing procedures and criteria for licensing and enforcement to ensure professional accountability and regulatory compliance.